cheaper cars low cost auto affordable auto insurance trucks

cheaper cars low cost auto affordable auto insurance trucks

Where You Live Can Increase Your Costs, Did you understand that city locations have varying degrees of greater cases prices? Higher thickness equates to more dangers, more mishaps and also even more thefts. Making use of 2011 stats, the average cases set you back per lorry in one city was 25% over that of an adjoining city.

The amount you'll pay for auto insurance coverage is impacted by a variety of very various factorsfrom the type of protection you need to your driving document to where you park your cars and truck. While not all firms utilize the exact same criteria, here's a list of what frequently establishes the bottom line on your automobile plan (insurance).

If you've had accidents or major web traffic infractions, it's most likely you'll pay greater than if you have a tidy driving record. You might additionally pay even more if you're a brand-new chauffeur without an insurance performance history. The even more miles you drive, the more chance for crashes so you'll pay more if you drive your automobile for work, or use it to commute fars away. affordable.

Insurance firms usually charge more if young adults or youngsters below age 25 drive your vehicle. auto insurance. Statistically, women often tend to get involved in fewer crashes, have fewer driver-under-the-influence crashes (DUIs) andmost importantlyhave less significant crashes than males. So all various other things being equivalent, females frequently pay less for automobile insurance coverage than their male counterparts.

, as well as the types as well as amounts of policy options (such as collision) that are prudent for you to have all influence exactly how much you'll pay for protection.

Getting My Minority Neighborhoods Pay Higher Car Insurance Premiums ... To Work

Car insurance coverage covers the lorry owner versus the economic loss(es) as a result of theft or accidental damages of the insured automobile together with the legal responsibility that may arise because of 3rd party losses. The protection is based on the terms and also problems mentioned in the policy document. It is necessary to have electric motor insurance policy if you possess an automobile as well as the plan fulfills your legal responsibility that might arise as a result of physical loss/damage or damages caused to a third party.

The setting of repayment will be once, at the time of acquiring the plan for the total policy duration. The car insurance coverage costs may differ in regards to expense, depending upon the insurance policy provider, the kind of auto, geographical location, the sort of insurance policy cover you have gone with, add-on insurance coverages, insurance plan insurance deductible, and numerous other elements, including your driving record as well as also your age. perks.

We hardly ever bother to read all the great print as well as have a tendency to focus on the highlights such as premium amount, insurance policy term, basic insurance coverages provided by the policy, etc. As the costs quantity is the prime emphasize while buying the plan, we have a tendency to just contrast the numbers without truly comprehending exactly how the quantity presented itself (cheaper car).

When you purchase a new cars and truck as well as acquire an insurance coverage, the insurer makes a decision the IDV based on the ex-showroom rate and also the devaluation as per the India Motor Tariff (IMT). Currently, the worth of your lorry starts diminishing annually based on the depreciation piece outlined in IMT.

It's suggested to choose the proper IDV depending upon the age and ex-showroom rate of the lorry to make sure that the automobile will be insured with sufficient coverage. car insurance. When you buy a new vehicle, its worth will be better than a four-year old vehicle. The insured proclaimed value or IDV is the worth that has been chosen for your automobile to determine its worth at the time of the claim & to calculate the premium as necessary.

How Credit Scores Affect Car Insurance – Nationwide for Beginners

At the time of renewal, the cost will be readjusted for any kind of devaluation to the automobile as well as the accessories. Mean you are purchasing an insurance policy cover for a cars and truck that is over 5 years old. Because situation, the IDV will be determined based on an understanding between you and also the insurance policy supplier after changing the worth after devaluation.

Please keep in mind that the IDV calculation applies just for the Own damages section of the insurance coverage and also out the legal third-party insurance coverage. Often the insurance firm prices quote a reduced premium by unnaturally decreasing the IDV and you require to be careful on this front. Age of the Car As your automobile expands old, it starts shedding worth due to numerous factors.

The key factor for the value depreciation is the general deterioration of the lorry contrasted to the brand-new version. Insurance provider have a set schedule that relates to automobiles as well as their market price depending on the age. The schedule is independent of the brand of the vehicle. auto. Usually, the schedule resembles this: Engine's Cubic Ability Every automobile's engine size is gauged based on its cubic capacity.

The vehicles in these cities are thought to be extra susceptible to mishaps and also theft. The insurance coverage costs for autos in Area A is higher than that in Area B. Third-Party Coverage In India, it is compulsory to have third-party coverage if you own a vehicle.

The amount differs from one person to another as well as additionally relies on the combination of the aspects discussed over (money). The lower line is selecting the right automobile insurance policy cover that supplies a comprehensive cover and also makes sure extensive security against monetary losses.

7 Easy Facts About What Is A Car Insurance Premium? - Bankrate Explained

What Is an Insurance policy Premium? An insurance coverage premium is the amount of money a private or organization spends for an insurance plan. Insurance coverage costs are paid for plans that cover health care, automobile, home, and life insurance policy. Once gained, the premium is revenue for the insurance company. It also stands for a liability, as the insurance provider needs to supply protection for cases being made versus the policy.

Trick Takeaways An insurance coverage costs is the amount of cash a private or service have to spend for an insurance plan. Insurance costs are paid for policies that cover health care, automobile, house, and also life insurance policy. Failing to pay the premium for the specific or business might lead to the termination of the policy as well as a loss of protection.

Life Insurance When it comes to a life insurance policy, the age at which you start insurance coverage will certainly establish your premium quantity, along with other threat factors (such as your current health). The more youthful you are, the lower your costs will typically be. Conversely, the older you get, the extra you pay in premiums to your insurance provider. trucks.

insurance company cheaper car insurance auto insurance auto

insurance company cheaper car insurance auto insurance auto

There is an energetic dispute between those who state formulas will change human actuaries in the future and also those who contend the enhancing usage of algorithms will need better involvement of human actuaries and also send the occupation to a "next level." Insurance providers make use of the costs paid to them by their customers and insurance policy holders to cover obligations connected with the plans they underwrite.

vehicle low-cost auto insurance cheap car low cost

vehicle low-cost auto insurance cheap car low cost

This can offset some prices of giving insurance protection and also aid an insurance firm maintain its rates affordable. While insurance coverage firms might buy possessions with varying levels of liquidity and returns, they are called for to maintain a particular level of liquidity in all times. State insurance policy regulators established the number of fluid properties necessary to make certain insurers can pay claims (auto).

Little Known Facts About Auto Insurance Premium Comparisons - Mass.gov.

The other choice is to attempt experiencing an insurance representative or View website broker. They have a tendency to collaborate with a number of different companies and also can try to obtain you the best quote. Several brokers can attach you to life, car, home, and medical insurance plans. It's crucial to remember that some of these brokers might be inspired by compensations.

Some insurance companies invest in the costs to generate greater returns. By doing so, the companies can offset some costs of giving insurance protection as well as aid an insurer keep its prices competitive within the marketplace. What Are the Trick Factors Influencing Insurance Policy Premiums? Insurance premiums depend upon a range of elements consisting of the sort of insurance coverage being purchased by the policyholder, the age of the insurance holder, where the insurance policy holder lives, the claim background of the insurance holder, and also ethical risk as well as unfavorable option.

What Is a Vehicle Insurance Policy Premium? Your auto insurance policy costs is just how much you pay for your vehicle's insurance coverage. liability. It's based on your driving record, car and also the coverage you select.

Driving Habits & Document Your present driving routines and your background of claims can affect your insurance policy costs. If you have actually had a whole lot of claims in the past, you'll likely pay more for insurance. If you have current tickets, your costs may be higher. Type of Cars And Truck You Drive The type of auto you drive can affect just how much you pay for insurance. cheapest car.

These quotes are tentative and might boost or lower as you proceed experiencing the purchasing procedure. Obtain a Quote for Vehicle Insurance Policy Today - credit score.

Our Michigan's Auto Insurance Law Has Changed Ideas

Your car insurance policy costs is the quantity you pay your insurance provider for coverage. Insurance companies establish your costs according to take the chance of elements, like driving history, age, credit report, and also extra. Due to the fact that automobile insurance coverage costs rely on a vast range of factors, your prices will certainly be various from what others pay.

Depending on your preference, you might pay an auto insurance policy costs on a regular monthly, semi-annually, or annual basis. If you fail to pay your cars and truck insurance coverage premiums, you could face a gap in protection and also have to pay more for insurance coverage in the future - affordable car insurance.

Just how are automobile insurance policy premiums determined? Insurance policy companies consider a selection of threat elements when computing your cars and truck insurance policy costs.

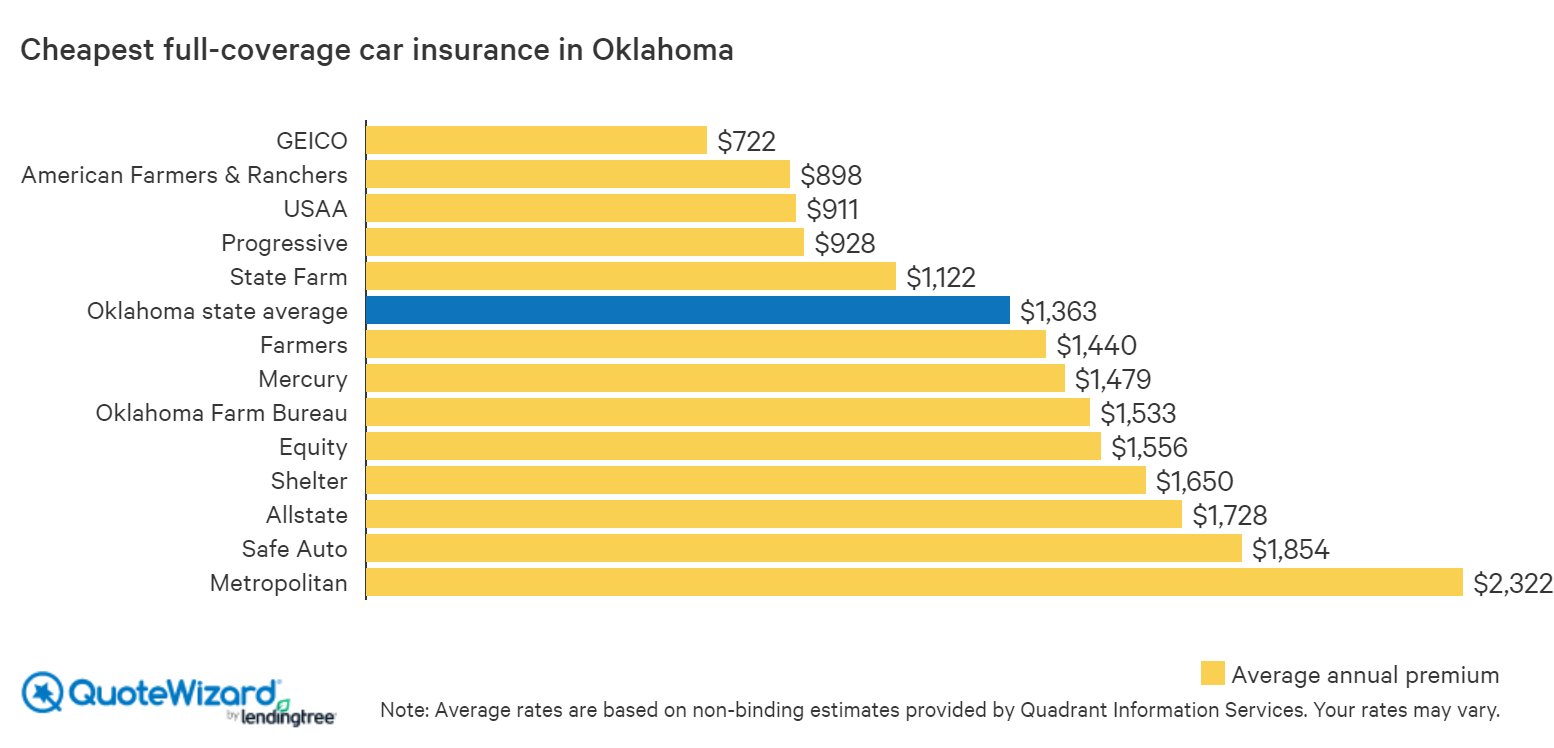

Your place: Auto insurance coverage costs differ relying on your state, city, and even postal code. automobile. Areas with more motorists, high prices of without insurance drivers, and high medical expenses frequently pay extra for insurance coverage. Your driving history: Vehicle drivers who have actually been involved in collisions, gotten tickets, or that are unskilled behind the wheel pay greater prices than their counterparts.

insurers perks car insurance perks

insurers perks car insurance perks

The ordinary auto insurance premium goes down if you can't pay for to pay for your premiums simultaneously or you just desire much more adaptability when planning your expenditures and also you decide to pay your premiums greater than as soon as per year. On the complying with table, we have actually provided the typical six-month and monthly premiums for different insurance coverage degrees.

Not known Facts About What Is A Car Insurance Premium? - The Zebra

vehicle car insurance auto insurance money

vehicle car insurance auto insurance money

If you're entailed in a crash and have to make an insurance claim, your costs will go up due to the fact that your insurance company thinks you're most likely to obtain in one more accident later. Since insurance claim settlements can be expensive for insurance coverage companies, they will raise your rates as a way to secure themselves against future losses - cars.

When you renew your insurance, you will certainly encounter greater automobile insurance coverage premiums for not having continual coverage. If this happens, you will have to discover a brand-new supplier before you can drive lawfully once again, Are cars and truck insurance policy costs much less costly if you restore insurance coverage?

When you renew your insurance policy, you will certainly face greater cars and truck insurance policy costs for not having constant coverage. car insured. If this occurs, you will have to locate a new service provider prior to you can drive legitimately once again, Are automobile insurance policy costs much less costly if you renew protection?